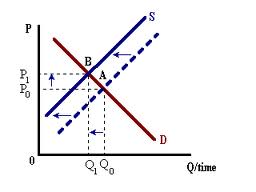

So it’s the cost of producing goods is tending to go down compared to its trading partners and that means if the exchange, if you get to some exchange rate, that may be an equilibrium today, then you just keep it there, in three years, this differential productivity growth will mean that China will have a growing surplus again. There are different estimates of how much appreciation you have to have to offset this productivity gain, but the lowest estimates are in the neighborhood of 3%-4%. So I would say that even though the current account surplus today is relatively small compared to four years ago, that these authorities should still allow the currency to appreciate 3%-4% per year at least, in order to prevent the surplus from ballooning back up again.

So it’s the cost of producing goods is tending to go down compared to its trading partners and that means if the exchange, if you get to some exchange rate, that may be an equilibrium today, then you just keep it there, in three years, this differential productivity growth will mean that China will have a growing surplus again. There are different estimates of how much appreciation you have to have to offset this productivity gain, but the lowest estimates are in the neighborhood of 3%-4%. So I would say that even though the current account surplus today is relatively small compared to four years ago, that these authorities should still allow the currency to appreciate 3%-4% per year at least, in order to prevent the surplus from ballooning back up again.

Question

You mentioned that under international appreciation policy and wondering what do you think is the income distribution fit of a financial repression and when China’s government is going to reform its financial issue and how to balance the economic growth effect and distribution.

Dr. Lardy

That’s another factor that I did not mention when I talked about the rising savings rate, but probably another factor contributing to the rise in savings rate is the fact that the income distribution has gotten a lot more unequal in the last decade. We know that people at the top of the income distribution save a much higher share of their income. Those are the ones that are buying the third, fourth and fifth house because they think it is a good investment. So you have a very high savings rate and so as the income distribution becomes more unequal, the people at the bottom have income so low, they cannot save anything or very little and people at the top have a lot of discretion and they tend to save a great deal. One of the factors contributing to these rising savings rate in this period is probably the growing inequality in the distribution of income. Most governments have found this very difficult to deal with in terms of via taxes or any kinds of redistributing programs. I am not sure what options they have, but I do think that most important one is to get off the capital-intensive growth path and to concentrate more income in the corporate sector, less income in the household sector, more growth of employment in the modern sector because growth of employment in the modern sector in the last seven or eight years has actually slowed down. So I think the kinds of policies that I talked about earlier would contribute indirectly to some reduction in the inequality, as well.

HOST

Alright. Before I conclude the lecture. Let me say that we will have a reception and those of you who still have questions and would like to talk to Dr. Lardy; the reception will be just here. Please join me. Thank you.

Sustaining China’s Economic Growth Pt. 26

economics expert witness